Slash Your Workers Comp and Group Health Expenses Up To 20%

Empirical data proves that when employees have access to more care and more cash, workers comp claims and health care expenses go down.

PARTICIPATORY WELLNESS PLANS

ESTIMATE YOUR BENEFITS AND SEE IF YOU QUALIFY

SEE IF YOU QUALIFY

RISK MANAGEMENT TOOLS

INTRO VIDEO FOR ENROLLED EMPLOYEES

BROCHURES - CLICK IMAGE TO DOWNLOAD

FREQUENTLY ASKED QUESTIONS

Is this program fully compliant when it comes to health insurance and tax codes?

ABSOLUTELY! See below and... (visit our complete compliance page here)

As stated on the CMS (Centers for Medicare and Medicaid Services) website, the Affordable Care Act supports participatory wellness programs, like the OACEUS 360 Wellness Plan. Implementing and expanding employer wellness programs may offer our nation the opportunity to not only improve the health of Americans, but also help control health care spending. The Affordable Care Act creates new incentives and builds on existing wellness program policies to promote employer wellness programs and encourage opportunities to support healthier workplaces.

The Department of Health and Human Services (HHS), The Department of Labor and the U.S. Treasury are jointly releasing proposed rules on wellness programs to reflect the changes to existing wellness provisions made by the Affordable Care Act and to encourage appropriately designed, consumer-protective wellness programs in group health coverage. These proposed rules would be effective for plan years starting on or after January 1, 2014. The proposed rules continue to support workplace wellness programs, including “participatory wellness programs” which generally are available without regard to an individual’s health status. These include, for example, programs that provide a reward to employees who complete a health risk assessment without requiring them to take further action. The rules also outline amended standards for nondiscriminatory “health-contingent wellness programs,” which generally require individuals to meet a specific standard related to their health to obtain a reward. Examples of health-contingent wellness programs include programs that provide a reward to those who do not use, or decrease their use of, tobacco, or programs that provide a reward to those who achieve a specified cholesterol level or weight as well as to those who fail to meet that biometric target but take certain additional required actions.

This Affordable Care Act ACA-compliant Federal program reduces an Employer's payroll taxes for all eligible employees. Eligible employees must be W-2 full-time workers working 35 hours per week. Non-eligible employees will be employees that are part-time, seasonal, per diem, or independent contractors (Form 1099). Other payroll factors will also be taken into consideration during eligibility. The company must offer health insurance. Health insurance is going to be utilized if your employees are sick or injured. The OACEUS Wellness Plan is going to promote health and help prevent disease for the intended recipient. All types of organizations are eligible to participate: Public, Private, Union, Non-Union, and Nonprofit.

For employers struggling with the rising cost of health insurance and ancillary benefits, a self-funded healthcare platform may be the answer to increasing employee benefits, while containing costs. Employers know all too well that although it is expensive to pay for employee benefits, it is still cheaper than losing talented employees with valuable experience. With average health insurance premiums rising faster than the consumer price index, employers are turning to consumer-directed health plans (CDHPs) and shifting more of the burden to employees through higher premium contributions, deductibles, copays and coinsurance. The authors answer 20 questions on how Wellness and Integrated Medical Plan Expense Reimbursement programs (WIMPER), provide incentives that allow employers to give cash reimbursements to employees, for individual and family medical care, as a result of participating in health and wellness plans. This follows the intent of the Affordable Care Act (ACA) which describes strategies to reward quality care through establishing payment structures that provide reimbursement for implementing wellness and health promotion activities. The healthcare platform is beneficial since it results in additional employee benefits, while also reducing costs for both employers and employees.

A self-insured medical reimbursement plan (SIMRP) is a separate written employer plan, which reimburses employees for medical expenses that are not provided by either an accident and health insurance policy or a prepaid healthcare plan (e.g., an HMO) that is regulated under federal or state law. In its simplest form, a Section 105 SIMRP is a direct reimbursement plan that allows an employer to reimburse employees for medical care expenses, such as insurance premiums.

The ACA increased incentives for employers to adopt self-insured healthcare programs. More focus is being placed on consumer-based approaches with an emphasis on preventative care. One approach is to establish a Wellness and Integrated Medical Plan Expense Reimbursement (WIMPER) program. This unified health care approach provides a tax-advantage, affordable means to purchase secondary health insurance products. A medical insurance plan along with a well-designed wellness program encourages employees to take personal responsibility to help minimize healthcare costs. When medical and wellness plans are integrated with a SIMRP, employees that participate in the wellness plan can be reimbursed to cover medical expenses.

The OACEUS 360 Wellness Plan was specifically designed to follow along with the structure of the WIMPER program and the regulations provided by the ACA. The focus of the benefits has been outlined to promote health and prevent disease. The WIMPER program identifies the IRC 213 (d) medical expenses as allowable benefits to be utilized with this tax code section. These specific types of benefits are focused on the diagnosis, cure, mitigation, treatment, or prevention of disease, which affects the body or mind.

The clear and very distinct difference between a wellness plan, designed like the OACEUS 360 Wellness Plan, and what other plans that are utilizing the same tax code section are on one side completely legitimate and the others are not in compliance. When utilizing the tax code defined in the WIMPER program, especially when it comes to using the allowed IRC 213 (d) benefits, the plan is deemed legitimate. Which companies can feel safe moving forward with, like the OACEUS 360 Wellness Plan.

However, on the other hand there are other plans that are using the same tax code section for medical reimbursement, but they are not using the IRC 213 (d) benefits. Instead, they are utilizing fixed indemnity plans. According to the IRS, fixed indemnity plans cannot have premiums paid on a pre-tax basis and benefit payments to employees that are also tax-free. If premiums for fixed indemnity insurance are made pre-tax, then the benefits are generally taxable, to the extent they exceed the individual’s actual medical expenses. Otherwise, it would be considered double dipping.

There are a large number of warnings and opinions out there regarding these plans, using the SIMRP tax code section, that are utilizing the fixed indemnity benefit; instead of the IRC 213 (d) benefits like the WIMPER program clearly outlines. Cash rewards received from a wellness program do not qualify as the reimbursement of medical care as defined under IRC 213 (d) or as an excludible fringe benefit under IRC 132, and therefore are not excludible from an employee’s income.

Simply stated, the WIMPER program is clearly structured to be in compliance by utilizing the IRC 213 (d) benefits. The other medical reimbursement programs using a fixed indemnity plan as the incentive benefit will not be in compliance due to the double dipping aspect.

Another distinguishing feature of the OACEUS 360 Wellness Plan is that participants are required to engage in the plan.

This is called a participatory wellness plan, which is the proactive approach to wellness. This also aligns with the guidelines provided by the ACA, DOL, HHS and the U.S. Treasury. In the pursuit of wellness, one must be their own advocate. The employee (participant) is incentivized with an additional life insurance policy. If the employee chooses not to participate, then they will be removed from the plan and the life insurance policy that was used as an incentive. The participation requirements are easy and simple engagements, such as uploading a co-pay receipt on their wellness portal or undertaking a diet and nutrition assessment. Most engagements should only take a couple minutes. But those couple minutes count towards participation.

Of course, the choice of engagement can go up from there, for example, using the counseling sessions or smoking cessation benefits. Some companies provide monthly wellness activities. Either way participation is very easy.

The goal is to create a healthier workplace by promoting health and the prevention of disease. All of this will improve and empower the company to have better attrition by enhancing their benefit package; which is all made possible with the OACEUS 360 Wellness Plan powered by WIMPER/SIMRP.

What is an example of a risk mitigation tool?

One example is a participatory wellness plan used in conjunction with a workers comp insurance policy. The plan targets specific aspects of wellness that are proven to reduce claims, therefore reduce premiums for workers comp. Through our workers comp insurance partners, we can significantly lower your client's work comp premiums.

What is a summary of the tools available to employees and their family?

Participatory Wellness

✔ 24/7 Access to health care resources for employee and family at no cost

✔ Mental Health Counseling - for employee or family

✔ Legal - one consultation per issue, unlimited issues

✔ Holistic Coaching with a registered nurse, four sessions per year per member

✔ Identity theft protection and recovery for entire employee household

✔ Health risk assessments

Universal Life Insurance

✔ Guaranteed Issue!

✔ Up to $150,000

✔ No physicals or blood work

✔ Guaranteed 3% annual interest rate

✔ Loan and withdrawal options

✔ Employees can take the portable, flexible policy with them

✔ Peace of mind knowing loved ones have extra resources

How do employees qualify?

Employers & Employees receive advantages with the Wellness Plan. These benefits pay for the plan, plus provide 213.d benefits to the eligible employees. These benefit amounts are determined in the following manner:

*Part-time employees are excluded based on the IRS codes.

*Employees must work at least 36 hours a week to be considered full-time.

*The company must offer health insurance

Is this available in all states?

The Participatory Wellness program is! However, there are four states are monopolistic when it comes to workers comp and those states are: WA, OH, WY, ND. Therefore there will be no reduction in Workers Comp in those four states. The company can still enjoy the other cost reduction benefits and improved employee retention and employees will still get the wellness benefits and guaranteed issue life insurance!

Do employees have to pay out of pocket for life insurance?

No, there is no reduction to employees net pay who are qualified and participating in the program. The policies are portable and can be funded by the employee when they leave / sever employment with the company.

What if we are self-insured for workers comp?

Excellent! We can still help a great deal. Self insured does not mean "free" right? We can complete a full analysis and STILL save you a bundle. The bottom line is that by improving overall wellness, employee morale and retention improve and productivity is enhanced.

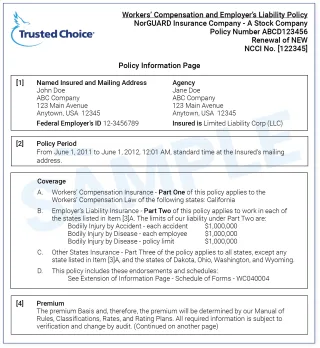

What is a Declarations Page or Dec Page?

Declaration Page or Dec Page for a Workers Compensation Policy...

The declaration page is the first part of your workers compensation policy. It is the section that describes your estimated payrolls, classifications, discounts, rates and credits on your workers compensation policy. This is also where the insurance company establishes your deposit premium for the policy period.

A declaration page is company specific. While the workers comp forms making up a policy are many times very standardized the dec, declaration, pages are very specific to each individual insurance company who issues workers comp policies. The insurance declaration page will generally be broken down into sections.

Typically the first section of the page will be listed or shown as Item 1 and will show information about the named insured such as their name, address and entity type.

The next section may show as Item 3 and will be detail information concerning the policy itself and will include; Section A, Workers Compensation Insurance, this section will show the specific state in which the workers compensation applies; Section B, employers Liability Insurance, part two shows how this section is applied to work in each state listed in Item 3 and also shows the employers liability limits as chosen by the policyholder; Section C, Other States Insurance, lists each state in which other states coverage applies.

Found within Item 4 on the workers compensation declaration sheet will be the premium calculation statement by the company, classifications, descriptions, estimated payroll, rates and estimated annual premium.

Also included on the workers comp dec sheet you will find the audit term, usually set as annual but may be another length of time, the policyholders federal ID number and its experience risk ID number as issued by the governing rate making authority for the resident state. The declaration will also show the minimum premium for the policy and all attached endorsements and policy forms.

So the workers compensation policy declaration pages include most of the factual information about the insurance policy.

NEED HELP? SCHEDULE A CALL TODAY:

Copyright © 2023 Maranatha Consulting LLC Privacy Policy

Click on the button below to learn about our affiliate program: